Climate Risk and Resilience: Due Diligence Assessment Approaches

Jan 8th, 2018 | By Sue Kemball-Cook and Alan Kao | Category: Climate Change

As society becomes increasingly aware of the impacts, risks, and opportunities associated with climate change, investors must broaden the scope of their environmental due diligence to include climate change considerations in their asset valuations and management strategies. Methods are needed to evaluate whether assets are vulnerable to business disruption due to the physical impacts of climate change. For example, if an asset is threatened by sea level rise or is likely to be affected by drought and water scarcity, the vulnerability of the asset and its operations to these climate risks may affect the asset valuation in the transaction. This article outlines an approach to assessing asset-level climate risk in environmental due diligence.

Why Evaluate Climate Risk in Due Diligence?

Given the relatively short timeframes during which a private equity firm might own a particular asset, a common attitude is that climate risk, with the long timeframes over which its effects are experienced, does not need to be evaluated. However, by understanding the potential long-term impacts from climate change, investors may be able to implement resilience measures that increase an asset’s valuation.

The G20 Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD) recommends treating climate risk on an equal basis with other material risks and guarding against the assumption that longer-term risks posed by climate change are irrelevant (1). The Guide on Climate Change for Private Equity Investors prepared by the Institutional Investors Group on Climate Change (IIGCC) and Principles for Responsible Investment (PRI) stresses the importance of evaluating a company’s management of climate change risks and opportunities. Also, BlackRock Investment Institute considers “ESG excellence as a mark of operational and management quality” (2).

When is Climate Risk Evaluation Needed?

A material finding related to climate risk could occur in the following situations:

- Assets are located close to a coastline and may be affected by sea level rise or storm surge

- Assets are located on a river in a region where flood risk is increasing

- Assets are located in a region where drought risk is increasing and water or energy resource scarcity and/or increased wildfire activity is possible

- Assets are located in a region with an increasing prevalence of severe heat waves that expose the asset to the potential for higher cooling costs and employee safety concerns

- The asset supply chain or value chain is affected by extreme weather events or resource availability

Approach to Climate Due Diligence

The climate risk assessment procedure used in due diligence should include a summary of location-specific weather- and climate-related risks and their potential impacts on the asset and site operations. These risks could include the following:

- Risks to infrastructure

- Threats to resource availability (e.g., water, power)

- Impacts from extreme weather on the supply chain, logistics, or operations

- Potential for increased operating costs

Climate risks vary by region and need to be evaluated with granular regional data.

The authors’ approach to assessing climate due diligence is aligned with the scenario analysis strategy for physical risk assessment recommended by the TCFD (3). In scenario development, an organization sketches out several alternative possible futures and develops a narrative describing the path to each future. Each narrative is typically organized around a central concept, such as “Business-As-Usual,” and together they span a range of outcomes for the organization. The TCFD recommends basing scenario development on publicly-available, macro-scale scenarios, which provide a framework and context for sector- or asset-specific analysis.

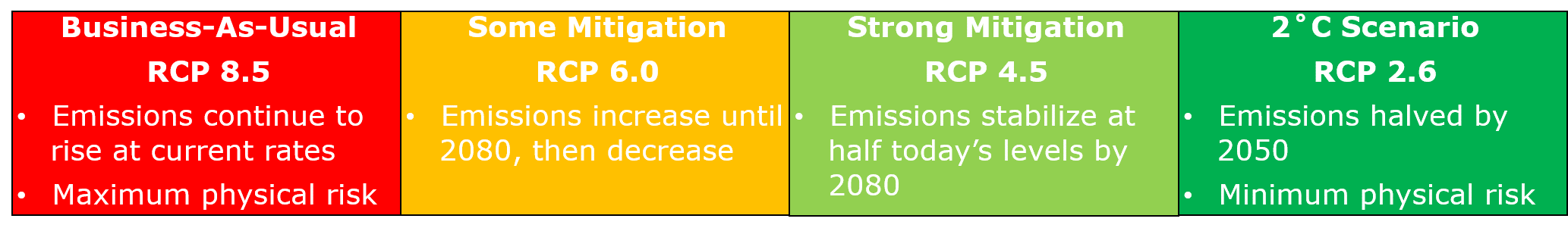

The Intergovernmental Panel on Climate Change (IPCC) Representative Concentration Pathway (RCP) scenarios describe the impact of greenhouse gases (GHGs) on the atmosphere through the end of the 21st century. These scenarios were used as inputs to an ensemble of more than 50 global climate models (GCMs) run by climate modeling groups worldwide that simulated the evolution of the earth’s climate system through 2100. The GCM data sets contain weather variables such as temperature, rainfall, and winds for all locations worldwide; these data can be used in the assessment of future physical risks due to the changing climate, such as increased prevalence of floods, heat waves, etc. Climate model simulation data for several GHG scenarios ranging from Business-As-Usual (RCP 8.5) to a potential 2°C future (RCP 2.6) are publicly available for all models (see Figure 1).

Figure 1. IPCC GHG RCP Scenarios

The GCM data provide a broad range of possible future scenarios for risk assessment. Each of the models represents a distinct, plausible version of the future, and many of the models were run with multiple RCP GHG scenarios.

GCM data are suitable for evaluating future physical risks on global or regional scales, but they may not be appropriate for evaluating some types of location-specific risks. For example, global models often underestimate observed extremes in rainfall and may not be suitable for evaluating flood risks, especially for a coastal or mountain site where the coast or mountain range is not simulated well by a global model.

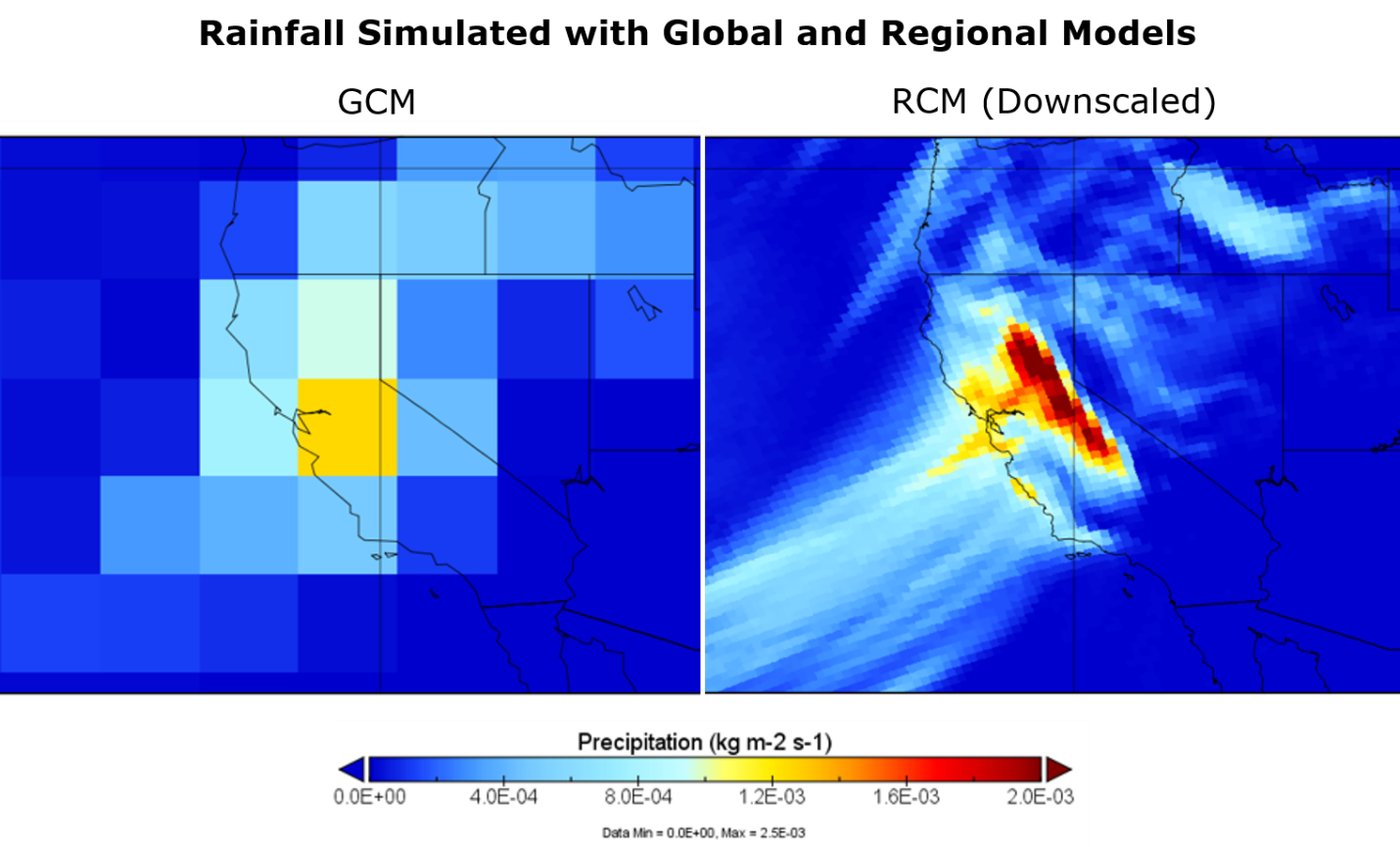

For site-specific, quantitative physical risk assessment, GCM data are “downscaled” or adapted for use at the local level using statistical techniques or high-resolution regional climate models (RCMs) that focus only on a single region. Figure 2 shows an example of rainfall data from a GCM and a downscaled version simulated by an RCM, which has higher spatial resolution than the GCM. The RCM, with its smaller grid cells, is better able to simulate the regions of higher rainfall (red areas of the maps) associated with mountain ranges. The higher resolution of the RCM captures the areas of enhanced rainfall along California’s Sierra Nevada Mountains. The simulation of the boundary between land and sea is far more realistic in the RCM.

Figure 2. Example of the effect of downscaling. Precipitation rate for a day in January 2090 as simulated by the CanESM2 global climate model (GCM) with 2.8° x 2.8° spatial resolution (left) and the CanRCM4 regional climate model (RCM) with 22-km spatial resolution (right). Climate model data are from the World Climate Research Programme’s Coordinated Regional Climate Downscaling Experiment (CORDEX).

Downscaling bridges the gap between GCM scale and regional/local scale. Also, in the downscaling process, new information is added to the GCM output from observations or RCMs, resulting in more realistic patterns for weather variables. The TCFD recommends using downscaled climate model data for scenario analysis, where possible (3). A limitation on RCM data is that it is expensive to develop and less widely available than GCM data in terms of geographic coverage and range of RCP scenarios modeled.

The wealth of climate data from different GHG emissions scenarios, climate models, and downscaling methods can give different projections of future risk for a given location. There is no way to know whether one modeled future is more plausible than another. No scientific consensus exists on the best method for downscaling, and expert advice is required to select among the data sets for a particular application and location. The authors’ approach to climate risk assessment in due diligence takes into account the range of RCP emissions scenarios as well as variations among models and differences in downscaling methods. The goal is not to provide a single estimate of the future value but a range of values that indicates the uncertainty in a climate projection. Consistent with the scenario planning approach, this allows both evaluation of the fullest possible range of risks to the asset and examination of its resilience under these potential stresses.

Method for Climate Risk Evaluation

In a due diligence assessment, downscaled climate change projections for the asset site are compiled, and a screening-level climate change impact assessment is performed for asset infrastructure and operations. Maps of current storm surge and flood risk are reviewed, if appropriate. For weather variables most relevant to the asset, downscaled projections are selected considering asset geography and the performance of the downscaling method and climate models used to develop the projection in simulating the weather variables of concern (e.g., rainfall). Where possible, projections from an ensemble of climate model simulations spanning a range of future GHG emission scenarios are used. The climate model data are then used to evaluate risks due to:

- Changes in average and extreme temperatures and precipitation

- Droughts and floods

- Changes in energy requirements (i.e. in degree heating and cooling days)

- Heat wave intensity and prevalence

- Wildfire risk

- Availability of resources (water, energy, etc.)

- Sea level rise

- Storm surge

The range of projections for each variable over the time horizon of interest are provided so the uncertainty in the projections is clearly reported and can be managed in future adaptation planning. The climate projections are used together with a detailed questionnaire in a systematic evaluation of climate risk. Asset and organizational resilience, supply chain vulnerability, and risks to business continuity due to climate change are assessed.

A summary of the climate risk assessment is prepared detailing all identified risks and highlighting those that are material. Findings from the screening risk assessment may indicate that a more detailed impact study or adaptation planning is needed. For example, a long-lived asset vulnerable to flooding during the asset hold period may require an adaptation plan that includes blue/green infrastructure for storm water management.

Conclusions

By assessing climate risk during due diligence, a buyer can value the asset more accurately through evaluation of threats such as sea level rise, flooding, and extreme heat. Climate risks can then be placed in context alongside other business, environmental, and legal risks in the transaction. Following deal closing, information from the climate risk assessment can be used to increase the asset’s value by implementing protective measures that build resilience against the identified climate risks.

The exact timing and severity of climate risks for a given site are uncertain and will depend on how GHG emissions change during the rest of the 21st century. Understanding the range of possible impacts to an asset allows for planning and active management of climate risks.

About the Authors

Dr. Susan Kemball-Cook is a Principal in Ramboll’s Novato, California office. She specializes in Climate Model Downscaling and has more than 20 years of experience in atmospheric physics and model development and application. Her expertise includes global and regional climate and air quality modeling and climate change risk assessment. She received her PhD in atmospheric science from the University of California, Davis, and her undergraduate degree from Yale University. Prior to joining Ramboll, Susan held postdoctoral appointments in global climate modeling at the University of Hawaii at Manoa and regional climate modeling at Lawrence Berkeley National Laboratory.

Dr. Alan Kao is a Principal in Ramboll’s Boston, Massachusetts office. He has more than 20 years of experience helping clients evaluate due diligence risks and opportunities in the areas of site contamination; environmental, health, safety, and product compliance; Environment, Social, Governance (ESG) management; and climate risk. Alan is also Ramboll’s Global Service Line Leader for Compliance, Strategy, and Transaction Services, which includes services related to the acquisition, operation, growth, and sale of companies, properties, and assets.

References

- Final Report. Recommendations of the Task Force on Climate-related Financial Disclosures. Task Force on Climate-related Financial Disclosures. June 2017.

- The Price of Climate Change. Global Warming’s Impact on Portfolios. BlackRock Investment Institute. October 2015.

- Technical Supplement. The Use of Scenario Analysis in Disclosure of Climate-Related Risks and Opportunities. Task Force on Climate-related Financial Disclosures. June 2017.

Photograph: Storm Over Sydney by Peter Aloisio.

Return to the EHS Journal Home Page